income tax filing malaysia

The e-filing system is the most convenient way to submit your income tax return in Malaysia. Personal tax filing can be done manually or online through.

E Filing Beginners Guide Q A Part 1 Income Tax Malaysia 2022 Youtube

Each has individual time limit that has been allocated for respected tax payers.

. But theres a much easier way to register. Malaysias annual personal income tax calendar is based on a 12-month period from the 1st of January to the 31st of December. Both residents and non-residents are taxed on income accruing in or derived from Malaysia.

Income tax return for individual with business. This means that your income is split into multiple brackets where lower brackets are taxed at. Once the new page has loaded click on the relevant income tax.

Then click on e-Filing PIN Number. Ensure you have your latest EA form with you 3. Online via customer feedback forms at.

These are the steps to fill up e-Filing online through the ezHASiL portal. If this is your first time. One of the things that we often overlook as fresher is filing the income tax Malaysia.

7 Tips to File Malaysian Income Tax For Beginners Melly Ling March 24 2021 1. The two category forms. E-Janji Temu Hasil e-Survey FAQs MCO 30 Bantuan Keluarga Malaysia Tax Payment Office Closing Notice Stoppage Order SME STAMPS More.

Non-residents are taxed a flat rate based on their types of income. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. Income tax return for individual who only received employment income.

Within 1 month after the due date. Visit ezHASiL and go to the website menu Customer Feedback. Efiling Tax Malaysia Watch this video until finishdont.

The tax filing deadline for person not carrying on a business is by 30. However you should still file your taxes even if you earn less than. Hak Cipta Terpelihara 2022 Lembaga Hasil Dalam Negeri Malaysia.

Head over to ezHASIL website. In Malaysia the process for filing your income tax returns depends on the type of income you earn and subsequently what type of form you should be filing. Efiling income tax malaysia.

Information on Taxes in Malaysia. Filing the income tax is for those who. Go to the LHDN e-filing.

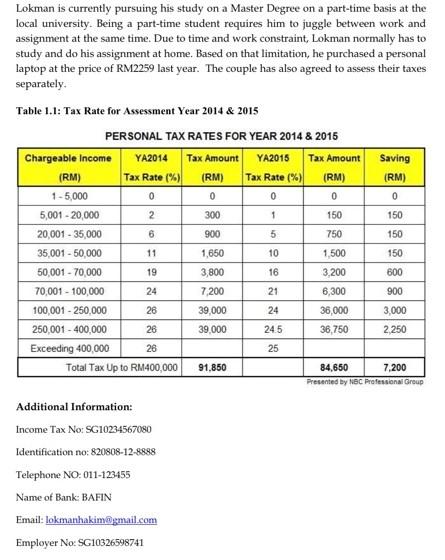

Thereafter enter your MyKad NRIC without the dashes and key in your password. After registering LHDN will email you with your income tax number within 3 working days. For resident taxpayers the personal income tax system in Malaysia is a progressive tax system.

First is to determine if you are eligible as a taxpayer 2. Heres how you can file your income tax with the e-filing system. Dimaklumkan bahawa satu sesi penyenggaraan sistem bagi ezHASiL akan dilakukan pada 12 Oktober 2022 Rabu jam 0600 petang hingga 12 Oktober 2022 Rabu jam 1159 malam.

Those who fail to do so can face legal action so make sure you do your part and declare your income. Start e-filing Click on the menu ezHasil services menu on the left-hand side of the screen then select e-filing. How to file your income tax Non-residents filing for income tax can do so using the same method as residents.

A lot of the freshers have the below misconceptions. 24 tax tax for individual. Income tax filing is carried out under two form categories in Malaysia.

Those who fail to do so can face legal action so make sure you do your part and declare your income. MyTax - Gerbang Informasi Percukaian. Malaysia has implementing territorial tax system.

The IRB has published on its website the 2022 income tax return filing programme 2022 filing programme titled Return Form RF Filing Programme For The Year 2022 dated 30. Here are the steps to file your tax through e-Filing. 30042022 15052022 for e-filing 5.

The submission of Return Form RF for. Registration of a tax file can be done at the nearest Inland Revenue Board of Malaysia IRB branch or online via e-Daftar at the IRB website with a copy of your. Malaysias personal income tax year is from 1 January to 31 December and income is assessed on a current year basis.

However even if you earn less than RM34000 annually you should still.

Vs Sri Associates Chartered Accountants Malaysia The Income Tax Filing Requirements Are Not The Same For Everyone Because It Varies According To The Type Category And Amount Of Earnings Of Each

9 Income Tax Ideas Income Tax Tax Income

Oveetha Management Services Income Tax Submission Is Due Very Soon If You Need To Do E Filing For Business Enterprise Income Tax Form B It Can Approach Me For Below

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Top 10 Tips On Filing Your Tax Returns The Star

Malaysia Personal Income Tax Guide 2021 Ya 2020

Electronic Filing Of Personal Income Tax Returns In Malaysia Determinants And Compliance Costs Semantic Scholar

How To File Income Tax In Malaysia 2022 Pt 2 Complete Guide To File Tax Returns Lhdn Youtube

Tax Guide For Expats In Malaysia Expatgo

Tax Dilemma The Income Of Any Person Including A Chegg Com

A Malaysian S Last Minute Guide To Filing Your Taxes

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Walau Malaysia On Twitter We Are Getting To The End Of Income Tax Season Here Are Some Tax Reliefs You Can Claim When Filing Your Income Tax For 2019 Https T Co Ot8zaf6or2 Ikw Ikwmalaysia

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Electronic Filing Of Personal Income Tax Returns In Malaysia Determinants And Compliance Costs Semantic Scholar

Company Car Benefit Should I Declare It On My Income Tax Filing

7 Tips To File Malaysian Income Tax For Beginners

Personal Income Tax E Filing For First Timers In Malaysia

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Comments

Post a Comment